Venture Insights Monthly Summary - July 2025

Important CVC deals, notable investors, and critical CVC articles

Important CVC Deals

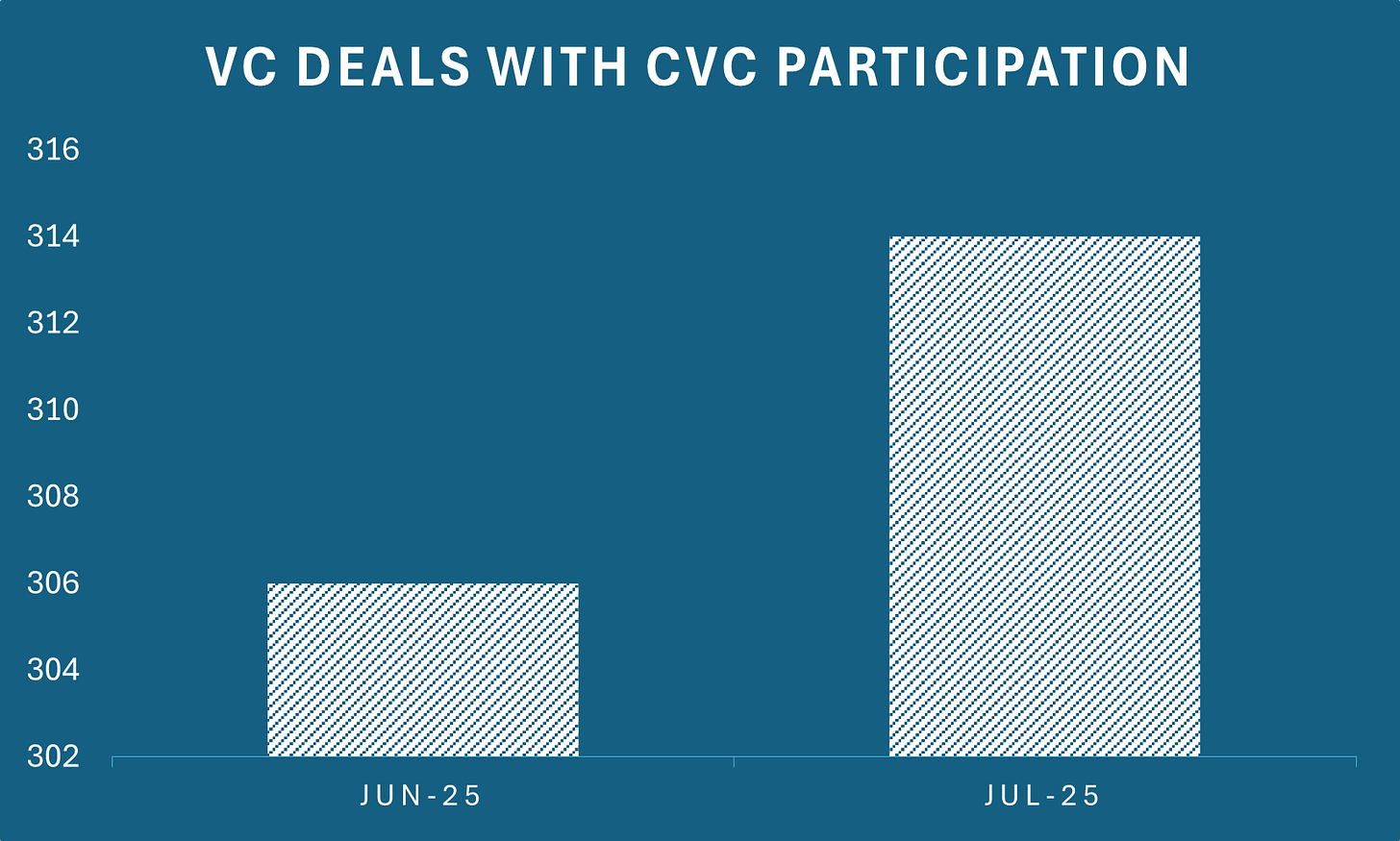

There were 316 VC deals with CVC participation completed in July, which was slightly up over last month’s 306.

Several deals grabbed my attention this month:

Lovable raised a $200 million series A, putting the post-money valuation at $1.8 billion. The company has been getting good press recently, demonstrating a leadership position in the software development platform industry. The company’s platform can be used to generate software without coding, creating an entirely new space for non-programmers to develop and deploy software in very short time.

Vanta, the risk compliance platform provider, raised a $150 million series D with a post money valuation of $4.15 billion. Governance, Risk, and Compliance (GRC) software is going to be more important as best-practice and workflows for complicated AI-enabled tasks become more complicated and integrated.

Noma Security, an AI security company, raised a $100 million series B on a $500 million post-money valuation. I’m optimistic better security integrations will drive broader adoption of AI tech in general at large enterprises.

Thinking Machines Lab raised an incredible $3 billion seed round with a post-money valuation of $12 billion. The company was founded by former OpenAI CTO Mira Murati, which may explain the outsized seed round.

The Thinking Machines Lab seed round is going to skew the medians for amount raised and valuation for not only this month, but for the year. (These extreme outliers cause data to be misinterpreted and misunderstood—we need to do a better job when using averages and medians to communicate where such outliers influence the analysis and attendant decisions.)

Notable CVC Investors

There were 286 different CVC investors that participated in the 314 deals. These are some of the corporate investors that I thought were notable.

GV led by activity with 8 investments in July in Ultromics (AI in heart health), Ramp (fintech), Farmers Business Network (agtech), Buena (property management), Thinking Machines Lab (AI…something?), Crash Override (application security), Open Evidence (AI in health), Rilla (consumer sales optimization)

Salesforce Ventures (which was also notable last month with 3 investments) completed 4 investments in Fal.ai (media / content generation), Netbox Labs (network management), Trupeer (another media / content generation), and UPWARD (sales optimization)

It was also encouraging to see AMD Ventures (3 investments), Hitachi Ventures (3), and M12 (3) participating in multiple deals.

Articles

I published the following 4 articles in July.

✍ 2025 Mid-Year Venture Insights: The first half of the year didn’t unfold as many expected

✍ Raising the Bar: How Revenue Expectations at Series A Are Quietly Climbing: The latest startups are earning more revenue, earlier

✍ Make Your Own Luck in Venture Capital: Fun article that explores 3 ways to manufacture better luck

✍ Reporting and Monitoring for Corporate Venturing, Part 1: Deep dive into how internal reporting can build credibility and earn the CVC a seat at the strategy table

The must-know headlines from my July articles include:

IPO’s lag and M&A leads for VC-backed exits, with 2025 shaping up to be similar to a lackluster 2024

CVCs continue to make more investments in early-stage companies while deploying more capital in growth-stage

The median revenue at Series A has steadily risen from $1.4 million in 2022 to $4.8 million

An internal reporting system based on best practices can drive alignment, build trust, and keep the CVC program funded

In July, my most read article covered how much more revenue Series A startups are earning compared to historical norms. The key takeaway is that the $1 million yardstick is no longer relevant and investors may begin to expect to see more revenue before committing.

Final Thoughts

If you missed any of these, check them out on Substack — and stay tuned for more perspectives next month.

In August, I’ll be publishing Part 2 of Reporting and Monitoring for Corporate Venturing, where I’ll be sharing practical advice and best practices for monitoring portcos post-investment. Be sure to subscribe to catch it as soon as it drops.